Why a 1% Drop in Interest Rates Changes Everything in South Bay Real Estate

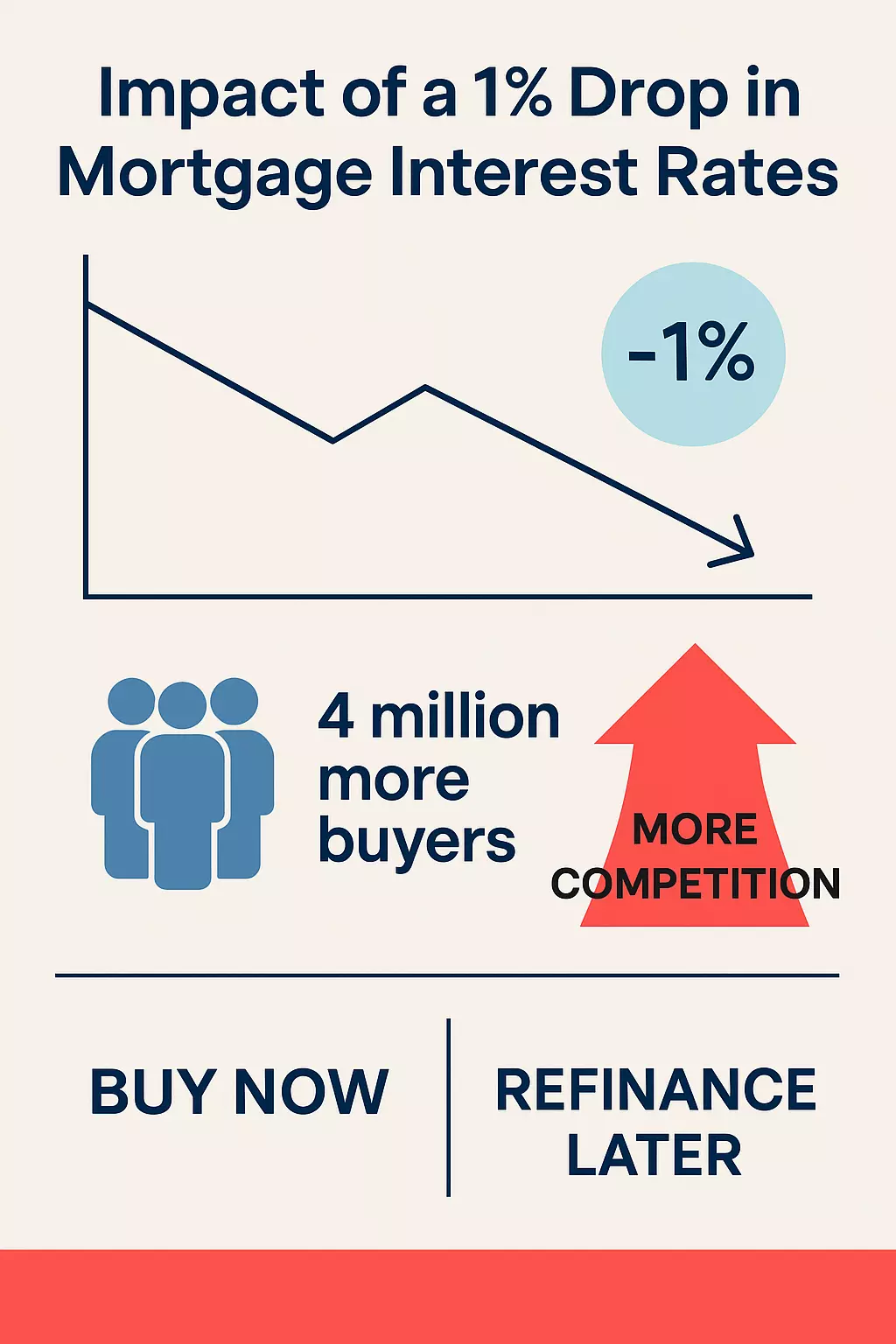

A Small Rate Drop Can Have a Huge Impact

When mortgage rates drop by just 1%, it’s not just a nice break on your monthly payment—it’s a market-shifting event. According to industry experts, around 4 million buyers enter the market when rates drop by a single percentage point. In competitive areas like the South Bay of Los Angeles—from Manhattan Beach and Hermosa to Redondo Beach, Torrance, and Palos Verdes—that shift can dramatically increase home prices due to buyer demand outpacing available inventory.

📈 Realtor.com reports that even modest rate drops increase affordability and send buyers back into the market.

What This Means for the South Bay

The South Bay is already known for limited inventory, coastal appeal, and strong buyer demand. When 4 million more people suddenly become eligible to buy across the U.S., markets like ours—where lifestyle meets location—feel the effects first. We see:

-

Increased bidding wars

-

Shorter days on market

-

Higher listing prices

-

More all-cash and over-asking offers

The result? A seller’s market, and prices climb fast.

Why Buying Now Could Save You More

If you’re waiting for interest rates to drop before buying, you’re not alone—but that could cost you more in the long run. Here’s why:

-

More buyers = more competition = higher prices

-

Homes you can afford today may be priced out tomorrow

-

Even if you pay a higher interest rate now, you can always refinance later

🏠 VeteranPCS.com breaks this down clearly: Buy now, beat the rush, then refinance when rates dip.

Let’s Look at the Numbers

Assume a $1.2M home in Redondo Beach at a 7% rate. Drop that to 6%, and your monthly payment falls—but now that same home might be listed for $1.3M due to increased competition. Waiting could mean paying more overall, even with a slightly lower rate.

🔄 NerdWallet shows how refinancing helps you adjust your rate once the market shifts, giving you a long-term advantage after you’ve secured the property.

Buying in South Bay Isn’t Just About Price—It’s About Timing

Cities like Palos Verdes Estates, El Segundo, Manhattan Beach, and Torrance often have fewer listings per capita than many inland areas. When demand surges, there simply isn’t enough to go around. If you’re serious about living in the South Bay, waiting for the “perfect” rate may push you into a much more expensive deal.

The Bottom Line

Buy the home. Date the rate.

If you find the right property in the right neighborhood now, you win—because you can always refinance later. But waiting for a lower rate may mean watching the home you loved sell for more… to someone who acted sooner.

If you’re curious about what’s possible for you now, or just want a no-pressure conversation about options in today’s South Bay market, I’m here to help.

Categories

Recent Posts